Quarterly Market Review, Q3 2022 by Dr. Kevin Hoang, Senior Economist & Data Scientist at Milk Chocolate.

The Prices

The Australian housing market has been undergoing a widespread correction over the last 6 months after a period of rapid growth in 2020-2021. According to CoreLogic's national Home Value Index (HVI), housing values have declined -1.6% over the month of August 2022, which is equivalent to a 20% decline on an annualised rate.

The annual trend in housing values is rapidly levelling out. After moving through a national peak annual growth rate of 21.3% (12-month rolling average) in November last year, the annual growth rate across the combined capitals has eased back to just 2.2%. Values across Sydney (-2.5%) and Melbourne (-2.1%) are now below the level recorded this time last year.

This trend is not unexpected because housing values have increased by 40% over the last 2 years across Australia.

Sydney continued to lead the downswing, with values falling -2.3% over the month, however weaker conditions in Brisbane accelerated sharply through August, with values falling -1.8%.

When looking more broadly at different price ranges, it is interesting to note that different segments reacted differently to the cash rate hikes.

The highest 25% suburb values have dropped at the fastest pace, especially in the most expensive capital cities including Sydney (-6.3%), Melbourne (-4.5%), Canberra (-2.2%), Hobart (-1.7%) and Brisbane (-1.4%) over the last 3 months.

In contrast, the middle 50% and lowest 25% of values have dropped quite marginally in comparison to the highest 75% of values.

Over the last 3 months, while Sydney and Melbourne have recorded the largest decline, housing values in Adelaide and Perth continue to increase by 1.6% and 0.4% respectively, and the housing values of the lowest 25% and middle 50% in Brisbane and Canberra remain in positive growth territory.

The Supply

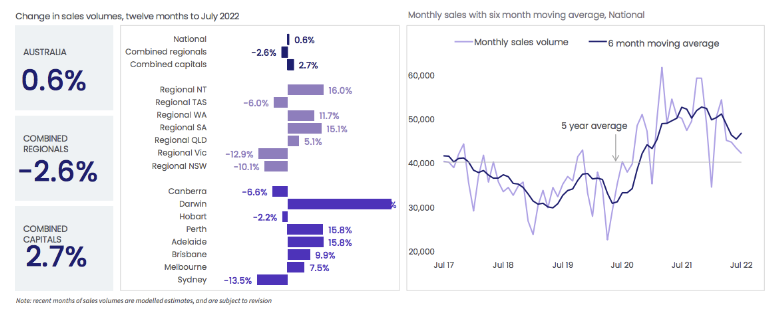

Capitalising on a rising market and low cash rate, the national sales volumes have been above the 5-year average trend in the last two years. Currently, approximately 45,000 properties were transferred per month, in comparison to the peak at 50,000 properties 6 months ago.

Interestingly, new listings that roll past 4 weeks on market are above the 5-year average, indicating that vendors are enticed to list their houses for sale due to multi factors including higher mortgage rates, prices remaining higher than a few years ago, and possibly uncertain economic climate. Notably, Adelaide, Sydney, Melbourne, and Hobart have recorded the largest increase in the number of new listings, while Brisbane and Perth have experienced a decline in the number of new listings in August in comparison to the same period last year.

We also anticipate a lower level of new housing supply in the next 2-3 years due to the delays and significant cost increases in construction and the disruption of the supply chain in Australia and globally.

The Demand

Australia's population grew by 0.9 per cent in the year to March 2022, of which net overseas migration added an estimated 110,000 people to the population and natural population increased by 130,000.

The strength in net overseas migration was driven by a large increase in arrivals (up 183 per cent on the previous year to 320,000) while overseas migrant departures held steady (up 1.5 per cent to 210,400). This result is a strong turnaround from overseas migration in the year to March 2021 (-94,300), but still trails recent pre-pandemic annual levels which ranged from 238,000 to 260,000.

The demand is further exacerbated by the return of workers to the major CBDs thanks to the normalisation of economic activities since early 2022. As a result, the demand for housing is high and the vacancy rate is currently at a crisis-low level across the country, and more severe in the major capital cities.

The rental prices have increased by 12% over the last 12 months for combined capital cities, which is the largest increase in many decades: Sydney (+12.7%), Melbourne (+7%), Brisbane (+16.9%), Adelaide (+11.6%), Perth (+10%), Hobart (+8%), Canberra (+11.3%) and Darwin (+3.5%).

The Cash Rate

The RBA has raised the cash rate continuously over the last 5 months: from 0.1% to 0.35% in April, 0.85% in May, 1.35% in June, 1.85% in July, and 2.35% in August in a bid to curb overrunning inflation.

As a result, the borrowing capacity for home buyers has been drastically reduced by 20-30% due to higher mortgage rates. We have seen the impact of the cash rate hikes in the most expensive markets including Sydney and Melbourne, where the mortgage size is higher in comparison to other capital cities.

In line with the objectives of the regulators, the % of loans originated with a loan-to-income ratio >=6 and % of loans originated with a debt-to-income ratio >=6 have been trending downward gradually thanks to the constraints in borrowing capacity.

The Controversial Queensland Land Tax Is Dumped

The Queensland government passed the land tax for interstate investors in Queensland where the tax rate is determined by the total value of land held nationally by investors. The new land tax would have been implemented from 1st July 2023. It was stipulated that: “A total national taxable land value would be established for each Queensland landholder, which will continue to exclude exempt land such as principal place of residences.

The national taxable value would have determined the appropriate tax rate that will then be applied to the Queensland proportion of the value of the individual or entity’s landholdings.

This was going to be a major land tax policy change for many years that would have seen investors bear the higher holding costs in the range of tens of thousands of dollars for the investors who hold just one property in Queensland at the median price.

Under high pressure from many industry groups, this controversial land tax was dumped by the Queensland premier on 30th September at the cabinet meeting in Canberra.

In Conclusion

The ‘market correction’ state we’re in at the moment is familiar to us, as we’ve experienced it over the past few decades. It’s largely driven by short-term factors such as interest rate changes or business cycles. The long-term fundamentals remain sound in Australia which includes high population growth and is one of the high-performing economies among the OECD countries.

The good news is that the pace of housing value decline is predicted to be stabilised from now until the end of the year, which is supported by: (1) housing shortage driving up rental prices that will entice more investors to return to the market; (2) population growth that is driven by the return of overseas migrants and students; (3) more optimistic macroeconomic climate that includes stabilising cash rate and lower inflation.

If you would like to speak with one of our research, planning, data, or analytics team members about the Australian market click here to book a complimentary session.

If you like this post, we’d love it if you could share :)

Disclaimer: All data and information provided on this site are for informational purposes only. Milk Chocolate makes no representations as to accuracy, completeness, recency, suitability, or validity of any information on this site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.